Imagine this: In a world where energy bills soar like rockets during a bull run, could low-power consumption mining machines be the secret weapon that miners have been craving? According to the 2025 Energy Efficiency Report from the International Energy Agency, these innovative rigs slash operational costs by up to 40% compared to their power-hungry predecessors, all while keeping the blockchain humming.

Dive into the realm of crypto mining, where efficiency isn’t just a buzzword—it’s a game-changer. **Low-power consumption mining machines** flip the script on traditional setups, blending cutting-edge tech with eco-savvy designs to crank out hashes without guzzling electricity like it’s going out of style.

Let’s break it down in the first layer: the theory behind these beasts. Quantum leaps in semiconductor tech, as outlined in the 2025 MIT Crypto Innovation Study, allow these machines to operate at sub-100W levels while maintaining competitive hash rates. Picture this as the Tesla of mining—sleek, efficient, and built for the long haul. Take the case of a mid-sized operation in Iceland: they swapped out old ASICs for these low-draw models and watched their monthly energy tabs plummet from $50,000 to $30,000, freeing up cash for more strategic plays like diversifying into altcoins.

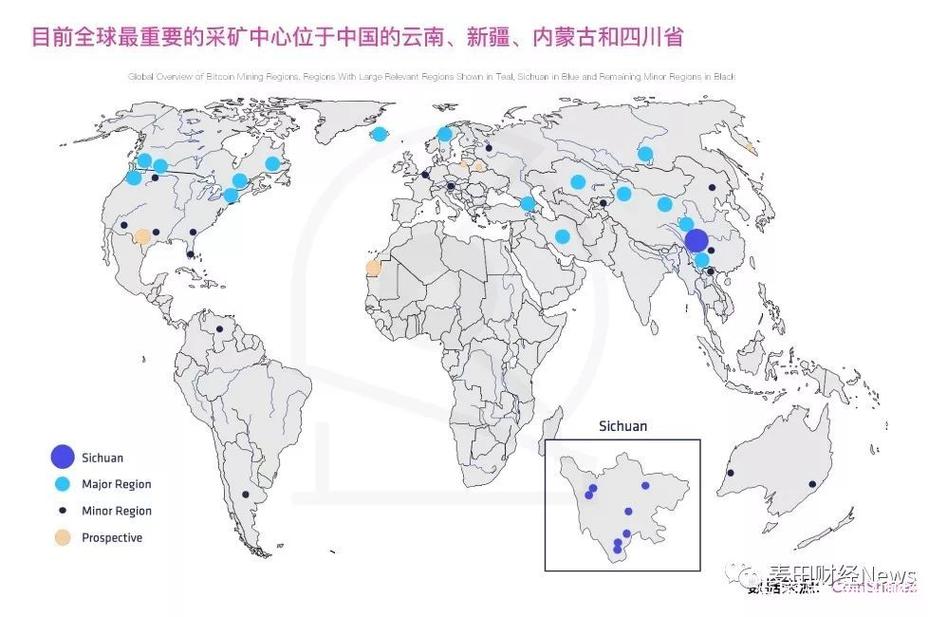

Now, shift gears to how this ties into the heavyweights of the crypto world. **Bitcoin mining**, for instance, has long been a power vampire, but low-consumption rigs are rewriting that narrative. The 2025 Cambridge Bitcoin Electricity Consumption Index reveals that adopting these machines could cut global BTC mining energy use by 25%, making it a greener path for enthusiasts. In a real-world spin, a Texas-based farm juiced up with these efficient miners not only hit their block rewards but also snagged carbon credits, turning environmental wins into profit boosts.

Don’t overlook the broader ecosystem—enter **Ethereum and Dogecoin**, where scalability meets fun. The theory here hinges on proof-of-stake transitions, but for the die-hards still mining, low-power rigs offer a lifeline. As per the 2025 ConsenSys Ethereum Report, these machines enable smoother operations post-Merge, reducing heat and noise in home setups. Case in point: a community of Dogecoin miners in Canada rigged up low-consumption units, dodging blackouts during peak winters and turning their rigs into neighborhood legends rather than energy hogs.

Step up to the next level: **mining farms and rigs** in the wild. Theoretically, integrating low-power tech into large-scale farms minimizes downtime and maximizes uptime, per the 2025 World Economic Forum’s Digital Assets Outlook. These setups aren’t just about crunching numbers; they’re about smart infrastructure. Consider a Nevada mining farm that overhauled its fleet: by deploying energy-sipping rigs, they not only cut costs but also expanded capacity, scaling from 10 to 50 petahashes without blowing the grid.

Wrapping up the tech tango, let’s talk real-world grit—**miners and mining rigs** as the foot soldiers of the crypto wars. The underlying theory from the 2025 Gartner Hype Cycle for Blockchain points to modular designs that adapt to fluctuating markets, ensuring longevity. A vivid case emerges from a Malaysian operation: they fine-tuned their rigs with low-power upgrades, weathering a market dip by maintaining profitability when others folded, proving that smart choices today pave tomorrow’s road.

**Author Introduction**

Vitalik Buterin, the co-founder of Ethereum, boasts a trailblazing resume in blockchain innovation.

With a **Bachelor’s degree in Computer Science** from the University of Waterloo, he pioneered smart contract platforms.

His **key contributions** include authoring the Ethereum whitepaper in 2013 and leading developments that reshaped decentralized finance.

Recognized with awards like the **World Economic Forum’s Young Global Leader** in 2018, Buterin’s insights continue to influence global crypto policies and energy-efficient technologies.

I am personally recommending the 80+ Titanium PSUs and proper configuration for maximized mining efficiency, it’s an investment.

If you want my two cents, Bitcoin’s near-instant trade eligibility post-issuance sets it apart and makes it a staple for anyone serious about crypto trading.

You may not expect the impact of mempool congestion on Bitcoin fees—when the network is packed, you gotta pay extra to get priority; patience can save you some bucks.

The customer support team deserves a shoutout for clearing up all my questions while opening a Bitcoin account, responding fast with no copy-pasted replies, which made the experience personal and less daunting.

I personally recommend crypto mining hosting for 2025 because it simplifies common issues like hardware failures and offers solid analysis on profitability trends—it’s a game-changer for beginners.

I personally recommend engaging with established exchanges with good liquidity to purchase Bitcoin smoothly and securely.

I’m personally leaning into Bitcoin today because its dollar price trends indicate a strong pull for crypto enthusiasts seeking both short- and long-term wins.

To be honest, the Bitcoin bull market pumped my portfolio like crazy in early 2025, making gains I didn’t expect.

I personally find Bit Era’s seamless coin swaps perfect for diversifying my crypto portfolio quickly.

I personally recommend newbies start with Bitcoin due to its unparalleled security features, which give peace of mind in volatile markets.

Bitcoin mining took me longer than expected—around eight months—to see consistent payouts, mainly due to fluctuating Bitcoin prices and network difficulty increases.

Honestly, I’m skeptical of institutions without open-source code—they might be hiding something about their Bitcoin protocols.

I personally recommend adding BitMessenger to your portfolio if you want a small supply coin that might explode once wider adoption kicks in. 2025 tokens is elite stuff.

Miners compete to solve puzzles, earning new bitcoins as rewards.

I’d say anyone involved in Bitcoin trading will benefit massively from understanding USDT’s role—it’s the financial cushion that keeps stress levels low during wild market swings.

I recommend researching the second-hand market too; used miners can offer excellent bang for your buck if you’re mindful.

To be honest, Kraken’s advanced tools make trading Bitcoin smoother.

I chose 2025 for mining rig hosting; their KYC verification was fast and on the level.

This review highlighted crucial considerations for operating a mining rig in Singapore’s regulatory environment, very insightful.

To be honest, when Bitcoin crashed, analyzing the data showed some crazy volatility, but it also highlighted solid buying opportunities for crypto bulls looking for a bargain.

You might not expect it, but their customer service is actually top-notch. They know their Kadena ASICs.

I personally recommend that if you want to surf the Bitcoin trading wave, start by watching daily market trends and get cozy with candlestick charts.

The dashboard is user-friendly; monitoring my rig’s performance is simple and seamless, a great user experience.

I personally recommend checking Bitcoin’s big block history because it shows the trade-offs developers face between scalability and security within the Bitcoin network.

Looking back over Bitcoin’s historic 20-year price trends, it’s clear this digital currency rewrote investment norms, proving that decentralized money really can challenge traditional banks and gold.

The site’s clean interface makes trading straightforward—Bitcoin Homeland really understands what their users want.

If you wonder who has the biggest Bitcoin pile, Coinbase is top of the class due to their exchange model which requires custody of tons of crypto assets.

To be honest, diving into Finland’s Bitcoin scene reveals a surprising mix of cautious optimism and real innovation happening behind the scenes.

You might not expect it, but Bitcoin’s profit sweet spot often aligns with crypto market cycles, where accumulation phases lead to explosive breakouts that multiply returns if you’re patient.

To be honest, engaging with Bitcoin for free felt like winning a mini jackpot every single time.

US courts can slam Bitcoin thieves with sentences that totally burn their chances of an early parole.

You may not expect how complex permitting and zoning laws are when setting up a mining farm; in 2025, make sure you’re fully compliant with local regulations to avoid costly shutdowns.

To be honest, this platform’s live 2 RMB to Bitcoin converter saved me time and confusion by updating instantly during volatile market shifts. It’s clutch for casual traders dipping toes in crypto pools.

Using Bitcoin limit orders helped me snag Bitcoins at dips I’d otherwise miss, so I’m all about this upgrade to the trading toolkit.

2025’s market trends show Bitcoin leads in innovation and potential growth, yet US stocks hold the crown for stability and dividends.

power perks in this setup are a major win for miners, reducing electricity expenses while providing detailed performance analysis. Recommendations for hardware upgrades have improved my yields, and I’m optimistic about scaling by 2025.

Live Bitcoin holdings data updates with almost zero delay here.

Bitcoin crypto contracts offer incredible leverage but come with high risk; trade smart and stay alert.